60

B

udgeting

BUDGETING 101

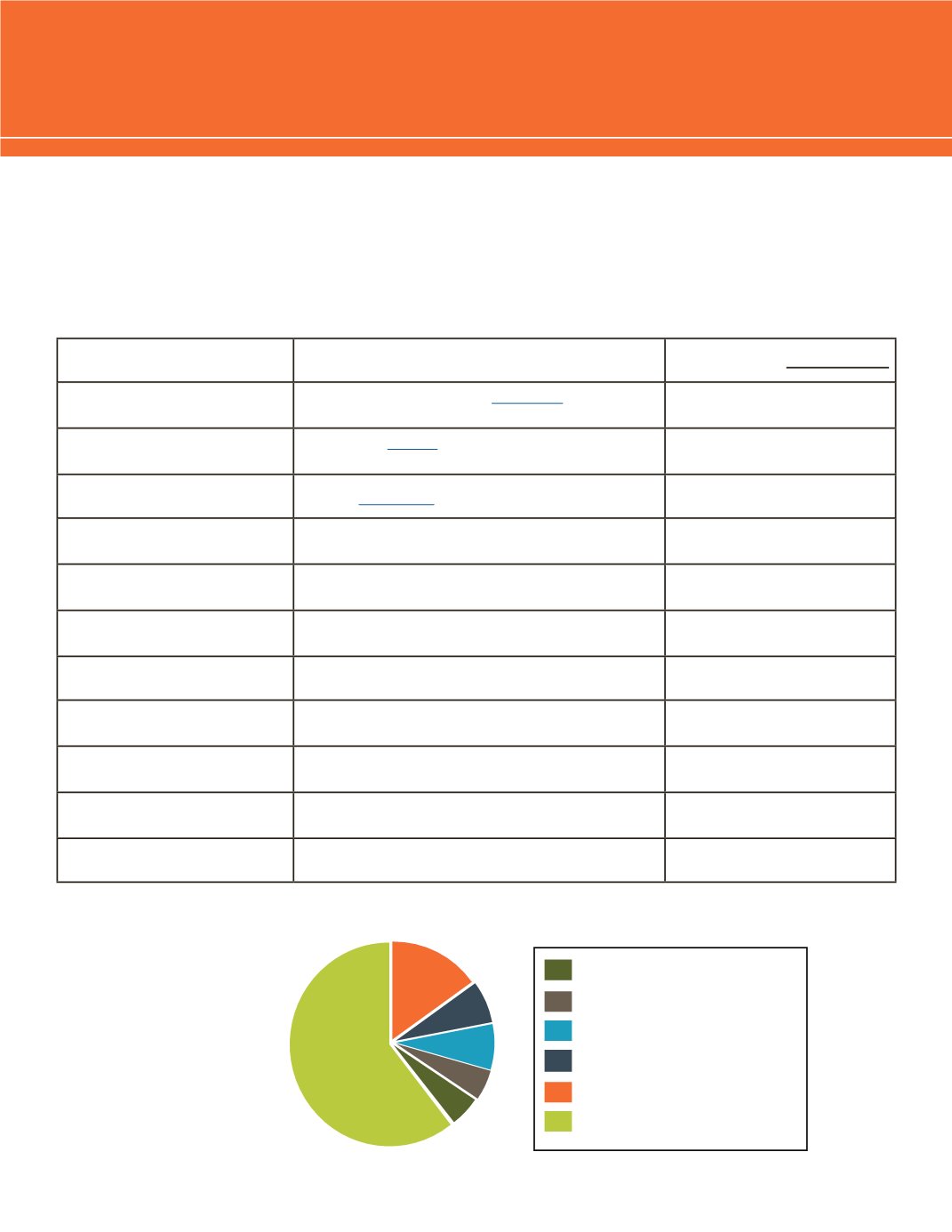

So you’ve accepted a great job offer and are ready to get to work. You have been living on a student budget for so long and

it is tempting to believe your money problems are now over. You rush out and lease a fancy apartment and buy a new car,

right? Wrong! The salary offer you received and the amount of money that actually shows up in your paycheck are drastically

different.

Here is why:

Re

t

i

re

m

e

nt

In

su

ra

n

ce

Pr

e

m

iu

m

s

So

c

i

a

l

Se

c

u

rity

State

Ta

xe

s

FederalTaxes

Retirement

State Taxes

Insurance Premiums

Social Security Withholding

Federal Taxes

Take Home Pay

ANNUAL SALARY: $30,000

YOUR TURN:

Federal Taxes (annual): $3,600

Sliding percentage based on

base salary

(12% tax bracket illustrated in example)

State Taxes (annual): $1,600

In SC, 0-7%

tax rate

depending on income

(approximately 5.3% illustrated in example)

Social Security (annual): $1,860

Current

federal rate

is 6.2%

Insurance Premiums (annual):

$2,400

Your contribution for health and dental insurance

varies - be sure to ask!

Retirement: $1,500

It is essential to save for retirement. Join your

employer's plan ASAP (5% illustrated in example)

Other Withholdings:

Employers can withhold fees for parking, uniforms,

fitness membership, etc.

Total Withholding: $10,960

Take Home Pay (Net Pay):

$19,040

Salary minus withholding

Monthly Paycheck (Net/12):

$1,587

Some employers pay monthly; budget wisely and

monitor your spending

Bi-weekly Paycheck (Net/26):

$732

Many employers pay bi-weekly or twice per month

Weekly Paycheck (Net/52): $366

Fewer employers pay weekly